Amid a flurry of market projection reports released this May, several global vertical farming market reports surfaced among them. It’s a segment of the indoor agriculture industry that has come along way in the past few years. Researchers estimate the global vertical farming market value was $1.15 billion USD in 2015, and project it reaching $6.31 billion by 2022 based on it’s current growth rate of over 27-30% a year (depending on what group did the report).

Compared to other global markets in agriculture that doesn’t sound like much of a market, but it’s growing rapidly. Market value reports and projections for 2016 are based on historical data, the most recent official figures a full calendar year being from 2014, though there would be partial year numbers for some of the industry in 2015. This leads to the market value for last year being an estimate. However, it very well may be a conservative estimate based on the numbers from 2014 market reports for vertical farming, which showed that over the year of 2013 the global market value was $403 million, and research analysts projected it growing to $1.97 billion by 2020.

The Forecast Certainly has Changed.

In 2 short years, the future value has increased over 320%, while historical value has more than doubled. But what is not apparent at first glance is that this market value has nothing to do with the actual food being produced by vertical farms worldwide. This is all about the value of the equipment and lights being supplied to commercial indoor agricultural growers around the world, and the reports are aimed at investors and industry manufacturers of grow lights, plant racks, and supplies and equipment for hydroponic and aeroponic systems.

The North American share of the world market for equipment and supplies used in vertical farming was 50% of the total volume according to a couple of these most recent reports. However, the fastest growing market segment is in Asia where plant factories are favored and increasing in number rapidly not just because of their plant factories, the smaller scale commercial vertical farm in a greenhouse has also expanded quickly over the past few years.

The researchers, and the possible purchasers of said reports are big players. Included in the list of companies interviewed is Green Sense Farms, who produces 1.5 million tons of lettuce, greens, and herbs for the Chicago metro area. FarmedHere, also from Chicago where they produce somewhere in the vicinity of 1 million pounds of lettuce and herbs a year, and said to be the largest vertical farming company in the US was listed, as was Aerofarms who is currently working on turning a massive commercial building into a huge indoor farm in New Jersey. One other US vertical farming brand from the US is mentioned in a 3rd report – Green Spirit Farm in New Buffalo, MI, who is an hour outside of Chicago, and about the same distance from Grand Rapids, but has a second location on the west side of Detroit too.

In all world market regions the rapid growth of indoor agriculture is directly related to increasing demand for healthy, pesticide free food that is not grown and shipped long distances, along with expanding urban populations, and a supply stream uninterrupted by weather problems. But there is a bit more to the reason that Asia Pacific countries are projected as the fastest growing vertical farming market region. All 3 of these reports also list interviewing Spread in Japan with the world’s first robotic indoor farm, and Sky Greens in Singapore. One might think this is because major vertical farming companies include well-known global corporations like Sharp, and Mitsubishi, but it’s really because 75% of the global vegetable consumption, and 66% of global fruit consumption takes place in this part of the world. And the there are the government subsidies for indoor agriculture expansion.

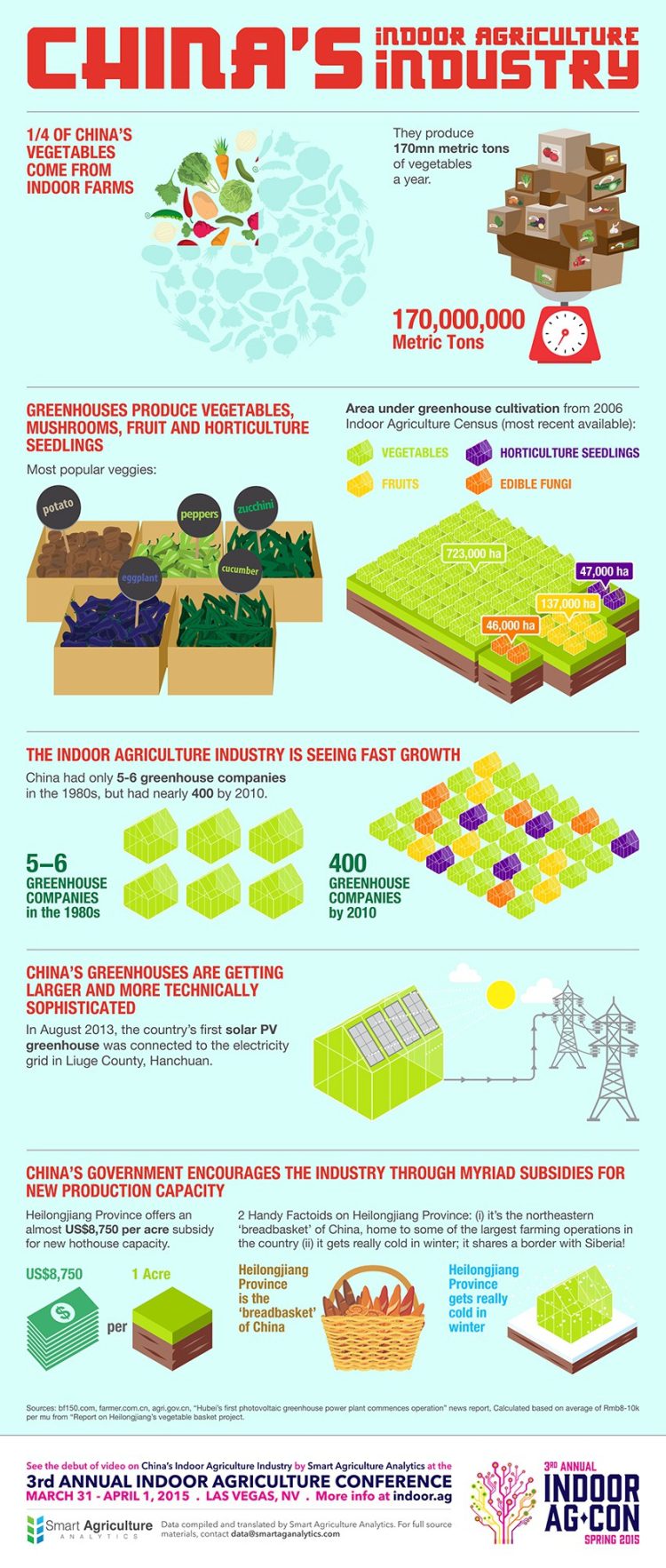

Meanwhile, in the largest vertical farming market, which is the US, the government subsidies go to soil farmers. China subsidies are $8750 USD per acre of indoor agriculture in it’s leading agricultural province, and 25% of the vegetables are grown indoors. Where would the growth go in such an environment – in any country on the planet? Look at this infographic from Indoor AG-CON:

The Picture Appears Lopsided

The actual amount of vertical farming or vertical gardening equipment being manufactured and sold worldwide may be only partially represented.

Without shelling out somewhere in the neighborhood of $15,000 USD to get access to these reports, one can only surmise that the only thing they are worried about conveying is how rosy the picture looks for big indoor food to investors.

“However, limited variety of crops, high initial investment and lack of technical insights are the restraining factors for vertical farming market.” — Stratistics MRC (Report 1)

At first glance, Report #2 looks like it’s the same as the first one, but the analysis projection has a much higher CAGR (Current Annual Growth Rate), and it’s priced higher too. The first published, Report #3, appears to include a broader scope of the vertical farming market, along with projecting farther ahead, and is far more costly to purchase of this group.

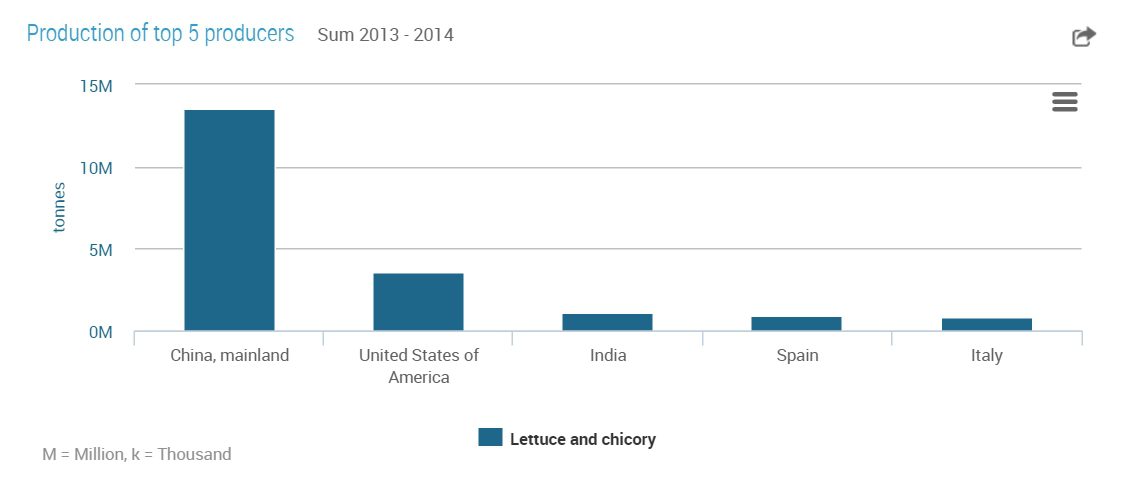

Still, the fact that there are specialists churning out these market reports and projections show that vertical farming is now a serious industry on a global scale. No one can lump food production growth in with cannabis in the vertical agriculture segment of indoor growing either, because well, tall plants just don’t stack well. But that’s also why the vertical farming investment researchers downgrade it to having restraints, because tomatoes (#1 selling vegetable globally) don’t lend themselves to the indoor plant factory model well either. Nor do most other fruit bearing crops, the exception being ground-hugging strawberries.

Top Lettuce Producing Countries 2013-14 (UN FAO) (source)

There is a no cost way to get more info on the true picture of indoor agriculture in China and Asia-Pacific countries. Newbean Capital, host of Indoor AG-CON, manages early stage venture capital, and has a special interest in agriculture, particularly the importance that indoor farming has to the future of feeding the planet. Not only do they recognize that the global vertical farming market reaches much farther than a handful of mega producers, but that this is just one small part of the big picture in indoor agriculture.

The first Indoor AG-Con Asia event took place in January 2016. It was sponsored by Microsoft, and the convention was held on the Microsoft campus in Singapore. Newbean has a white paper report on the industry in this region that any company representative can download by filling out a form. It’s rather interesting. You’ll find the form HERE, along with one on robotics and automation in indoor agriculture compiled for the October 2015 Indoor Ag-Con held in New York. The next New York convention, Indoor AG-CON Gotham is scheduled for October 2016.